Reinventing branch banking: A three-pillar approach for transformation

Juli 13, 2023 / Satya Swarup Das

Short on time? Read the key takeaways:

- Reevaluating your customers’ needs and experiences at your branch locations could bring your branch banking operations back to equilibrium.

- The goal is to create an interactive and friendly environment where customers can seamlessly navigate digital and physical touchpoints, receiving personalized support at every step.

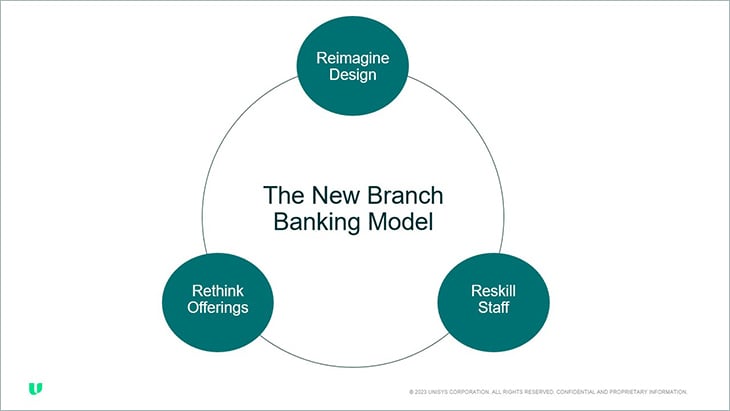

- To embrace a digital-first strategy, banks must consider a new model that reimagines design, rethinks offerings and reskills staff.

- Adopting this new branch banking model and using innovative technologies can help banks meet customers' expectations and drive growth and differentiation in a changing industry.

Banking is in its "phygital" era. As banks bridge the gap between physical and digital offerings and capabilities, they're searching for ways to meet customer needs and expectations. And that means changes.

But these changes have been a long time coming. Customer preference for digital channels has reshaped how traditional brick-and-mortar branches are adapting to this new reality. Previously, bank branches primarily served customers with a transactional focus. Customers would visit branches seeking assurance and personalized assistance, which digital channels couldn't provide. However, a radical shift toward digital channels has forced banks to reimagine their offerings. This shift has disrupted the equilibrium between digital and branch channels, leaving banks to rethink their branch strategies.

That’s not to say all customers are digitally savvy; many still rely on in-person interactions, especially for complex interactions, including mortgage applications or financial planning. According to a recent Banking Outlook survey conducted by BAI1, customers expect to do about 60% of their banking digitally by 2024, leaving about 40% still requiring in-person interactions.

While larger banks have started their journey toward finding the right balance between digital and branch offerings, others are still figuring out the best model to meet customer needs and remain competitive. What follows are practical strategies banks can employ to strike the right balance between digital and branch offerings. Discover the three-pillared approach to help your bank operations evolve to enhance customer experience and drive growth.

Meet the new branch banking model

Right now, branch banking is a balancing act. But reevaluating the needs of your customers and the experiences your branch locations could provide could bring your operations back to equilibrium. The goal banks must strive for is to create an interactive and friendly environment where customers can seamlessly navigate digital and physical touchpoints, receiving personalized support at every step.

To address the challenges of balancing branch offerings with a digital-first strategy, banks must consider a new model that reimagines design, rethinks offerings and reskills staff. Let's delve into each pillar with examples.

Pillar 1: Reimagine design

The first pillar of this new model calls for branches to evolve to become customer experience centers rather than transaction delivery centers. You can transform the physical environment by replacing traditional one-to-one counters with flexible counters that serve different customer needs. And if you equip staff with tablet devices, they can move around the branch, enabling interactive and personalized customer interactions.

By transforming branches into experience centers, you can deliver a balanced mix of digital and in-person experiences. Interactive lounges with tablet-equipped staff and customer self-service kiosks provide an environment where customers can explore digital offerings while receiving personalized assistance. These casual, experiential interactions can help your staff comprehensively address your customers' needs.

Need more inspiration? Imagine replacing your branch locations' traditional teller counters with collaborative workstations, where customers and staff can engage in personalized discussions about financial goals and solutions.

Pillar 2: Rethink offerings

What if branches could focus on providing advisory services and leveraging technology to enhance customer experiences instead of merely processing transactions? Banks can leverage customer insights, digital workflow-based solutions and virtual offerings to infuse a new level of experience into their branches. AI-powered systems that provide a holistic view of the customer can enable staff to handle queries, offer personalized advice and guide customers towards the most suitable financial solutions.

Reinvigorating your approach could also eliminate one of the peskiest parts of the customer experience: waiting. Digital appointment bookings and pre-assigning staff to specific time slots can reduce waiting times and customer anxiety.

Picture this: a bank introduces virtual mortgage and loan application support, where customers can connect with experts via video conferencing within the branch.

Pillar 3: Reskill staff

One of the most important aspects of branch banking evolution is people. To make any new business model work, branch staff must shift from a transaction processing mindset to becoming customer interaction specialists. To do this, banks could prioritize staff flexibility by offering variable working hours, time off and opportunities for learning and upskilling. Happy staff means happy customers. Ensuring staff satisfaction and improving employee experience will translate into happier customers and improved customer experiences.

How does this work? A bank invests in comprehensive training programs that equip branch staff with advanced product knowledge, soft skills and digital banking expertise. This enables staff to handle multiple products and guide customers throughout their banking journey, creating a seamless and personalized customer experience.

Putting the model into action

Banks must begin with a comprehensive planning exercise to implement this three-pillar model successfully that involves high-level considerations, such as:

- Reviewing current services and procedures

- Finding the best balance between branch-based and online offerings

- Reimagining the branch landscape

Implementing a new approach takes time and, most importantly, stakeholder agreement. Once the planning and redesign phases are complete, banks must analyze the skill levels required to execute the new branch model effectively. This analysis will decide whether reskilling existing staff or hiring new talent must align with the action plan.

Ensuring the successful implementation of the recommended changes requires careful planning and a commitment to cost savings and efficiency improvements. Moreover, there are also opportunities for banks to generate more revenue. As customers experience better service, time-saving convenience and improved experiences, they are more likely to pay for select services and offerings.

Redefining the branch experience for a digital-first world

This "phytigal" era has challenged banks to find the right balance between digital and branch offerings. By reimagining branch design, rethinking offerings and reskilling staff, banks can enhance the customer experience and remain competitive in the evolving banking landscape.

With a focus on a digital-first strategy and a human touch, banks can transform their branches into engaging experience centers that combine the convenience of digital channels with the reassurance of in-person interactions.

By adopting this new branch banking model and leveraging innovative technologies, banks can meet customers' evolving expectations and drive growth and differentiation in a rapidly changing industry. It's time for banks to embrace the future of banking and redefine the branch experience for a digital-first world.

But each bank is different and must figure out its unique approach. Looking for help from knowledgeable vendors and industry experts and conducting industry benchmarking can help calibrate their new offerings with industry best practices.

Unisys can help financial institutions in their transformation journey. As a trusted provider of branch, core and digital banking solutions, Unisys can help you align your needs with products and services that meet the unique needs of each bank.

To learn more about Unisys can help evolve your banking operations, learn more or contact us today.

1 BAI, “A look ahead to banking in 2022,” a-look-ahead-to-banking-in-2022.pdf (bai.org)